Retirement Risk #2: Inflation & Unpacking the Big Stock Market Lie

When I ask folks about their biggest retirement fear, what answer do you think they give?

Their #1 retirement fear is running out of money.

The #2 fear is how much money they can actually take from their investments. (Which is really just another permutation of fear #1.)

The truth is that the vast majority of people are afraid to spend money during their retirement. Even when they’ve saved $1 million, $2 million, and even $3 million.

That’s simply because having a big portfolio is no protection against the 3 big retirement risks facing all retirees.

This article is about facing and overcoming Retirement Risk #2: Inflation.

(Learn more about Retirement Risk #1: Market Volatility in this article.)

Inside this article, I’m going to break down some practical concepts you need to understand about inflation and how you can apply them to your own retirement.

Concept #1: Why inflation is so dangerous

Concept #2: The “Big Stock Market Lie”

Concept #3: Fighting inflation in your portfolio

Let’s dive in.

Why is inflation so dangerous to your retirement?

To truly understand inflation, let’s go back into history.

It may not seem like a lot, but you already know the impact that quiet erosion of your money has on everything.

Now imagine that same effect going forward over the next 30 years. In just 24 years, that average inflation of 3% would cut the purchasing power of a $1 million portfolio in half.

And that’s assuming inflation returns to its historical average.

We have the recent history of 2022, when inflation tripled and hit 9.1% a year.

While you’re working, you can generally count on your income to increase every few years to account for inflation (and your increases in skill and experience.)

But what happens in retirement? The conventional advice you’ve probably heard a hundred times is that you need to invest heavily in stocks to fight inflation.

We also have to consider the impact of “uneven” inflation. For example, healthcare costs tend to rise faster than general inflation.

Unpacking the Big Lie About the Stock Market

You’ve probably heard that the stock market returns about 7% a year, on average.

And the relatively high return is supposed to be the benefit of taking on all the risk and volatility of being a stock investor.

But is that actually true?

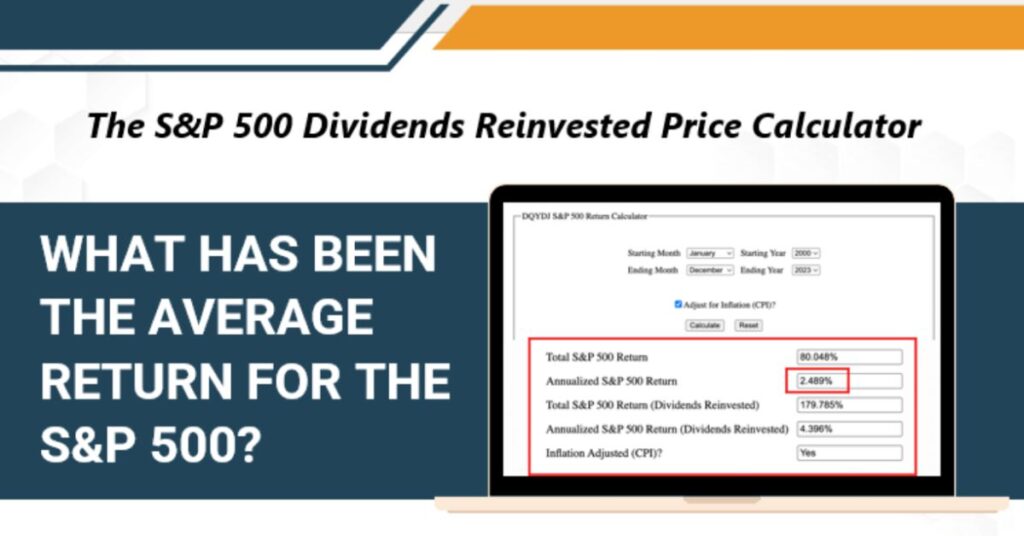

When you actually account for inflation, you see that the S&P actually only returns about 2.8%!

That’s it! For all the ups and downs and losses, you’re only getting back less than 3% when you take inflation into consideration.

Does that feel like enough return to be taking on all that risk?

When you’re taking on the risk of a 2008 or a 2020 event, it’s certainly not a lot.

When you look at the last 24 years, you’ll see that the S&P 500 has only been down 6 years.

So, how do you go about protecting your retirement from inflation?

Take an Income-Based Approach to Fighting Inflation

Ultimately, our goal is to create a lifetime stream of income that will cover your needs, wants, and wishes without drawing down too much of your principal — while keeping up with inflation.

Instead of chasing market performance in a market-based portfolio—which will always be at risk of the next downturn—think about fighting inflation and creating income using investments that are not correlated with markets.

An income-based approach to retirement allows you to create stable retirement income while mitigating the risks of inflation.

For example, including the inflation-fighting powers of certain alternative investments in your portfolio allows us to pursue growth while mitigating the market risks of a traditional portfolio.

Retirement Confidence is About Creating Income (And Fighting Inflation)

Ultimately, being able to have confidence in your “personal pension” paycheck isn’t about capturing every percentage of market growth. It’s about avoiding the biggest mistakes and mitigating the biggest risks.

If you’re looking ahead to your own retirement and wondering how you’ll turn your portfolio into income, you may be ready for a conversation about income-based retirement planning.

If you think the market game is rigged against retirement investors, then we should talk.

It’s why I developed a philosophy centered on creating stable, lifelong retirement income that doesn’t depend on volatile markets.

You can read more about my Lifetime Wealth BlueprintSM here.

If you’re:

- A diligent saver who is prudent with their money

- Seeking careful growth and protection from markets

- Able to invest at least 1 million dollars for your retirement

- Seeking retirement income that lasts

And you’re interested in collaborative advice that will connect you with investment options while leaving you in control of your decisions.

I’d like to invite you to an intro meeting with my team.

It’s the fastest way to get personal answers to your questions and get my advice on your own retirement.

It’s free to meet, and there’s no obligation to do anything else.

Just click the link and schedule your call.

Risk Disclosure: Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding the accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision.

For illustrative use only.