Sequence of Returns Risk: The Hidden Danger to Your Retirement Portfolio

- Entering the Fragile Decade

- Retiring Just Before the 2008 Market Downturn

- What is the Sequence of Returns Risk? (And Why is it So Dangerous?)

- Susan and Mark had a Hard Decision to Make After the 2008 Crisis Damaged Their Retirement Portfolio.

- A Radical Solution to Sequence of Returns Risk: Think Income, Not Markets

- Retirement Confidence is About Creating Income (And Preserving Your Principal)

- BlackRock’s Fink Says 60/40 Portfolio Is Dying, Vows to Open Private Markets to the Masses

- Beyond Money Personality: A Better Way to Plan Your Retirement Income

- Retirement Risk #2: Inflation & Unpacking the Big Stock Market Lie

“Markets can remain irrational longer than you, and I can remain solvent.”

— A. Gary Shilling

You’re entering a critical phase in your retirement journey—the “fragile decade.” To adapt, everything you know about smart investing must change.

The five years before and after you retire can make or break your retirement lifestyle because of how dangerous markets can be to your portfolio.

In this article, I’m going to break down some practical concepts you need to understand and show you how you can apply them to your own retirement journey:

- Concept #1: The Fragile Decade

- Concept #2: Sequence of Returns Risk

- Concept #3: Investing for Retirement Income

Entering the Fragile Decade

Let’s start with a definition: the “fragile decade” is the five years before and after you retire.

During this period, your investing and financial decisions can profoundly impact your retirement lifestyle. Possibly more than at any other point in your life.

Why? Because market volatility can pose major risks to the health of your portfolio, especially if negative returns occur early in retirement. We’ll dive more into return risk a little later.

Retiring Just Before the 2008 Market Downturn

Here’s a quick story about two clients, Susan & Mark: They were DIY investors who retired in 2007, just months before the financial crisis and major market downturn. Their portfolio took major losses, and they came to me as prospective new clients, wondering what to do next.

During the fragile decade, the “conventional” investment strategies you’ve been following may no longer fit. You need to adapt your investing approach to reduce the impact of market volatility and help ensure that you can create stable income when you need it.

If Mark and Susan had gotten my advice before they retired, they might not have been so adversely affected by the 2008 downturn. Once the damage had been done, our options were more limited — that’s the danger posed by the fragile decade.

What is the Sequence of Returns Risk? (And Why is it So Dangerous?)

“Sequence of returns” risk refers to the danger to your portfolio of poor market returns combined with the withdrawals needed to create retirement income.

The sequence of returns doesn’t matter during your career (the accumulation phase when you’re building your portfolio).

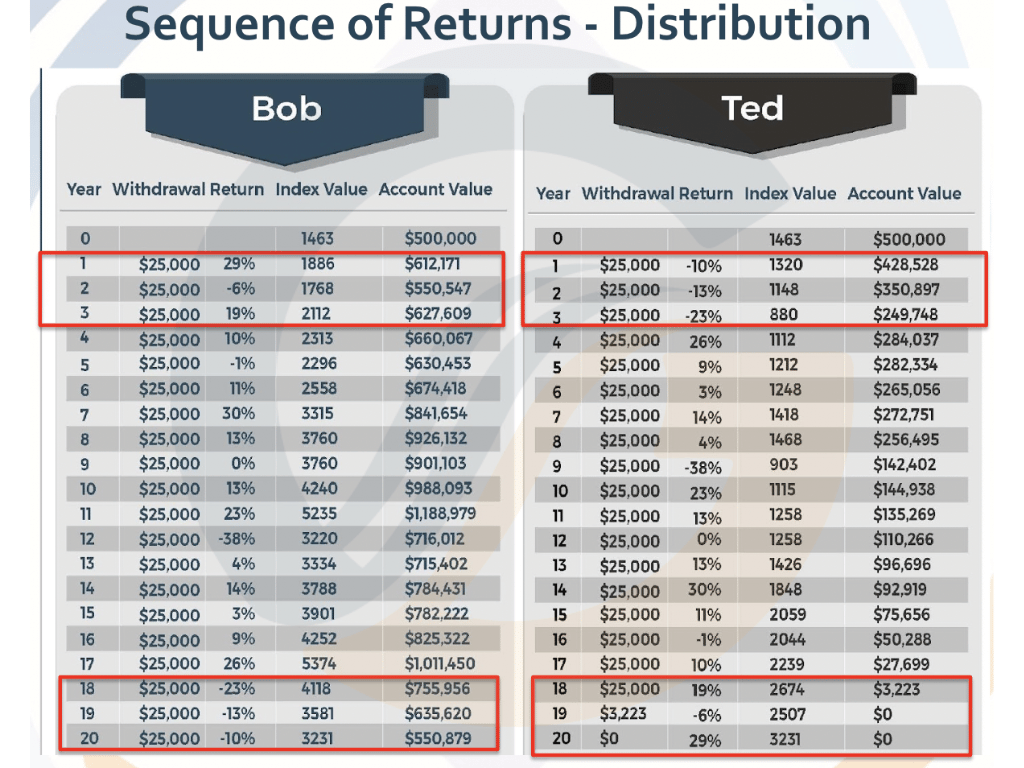

Here’s a quick illustration of two portfolios with a reversed sequence of returns.

Bob and Ted both started with $500,000 in their portfolio and ended with the same amount 20 years later.

However, Bob saw positive returns early and finished with three years of negative returns.

Ted experienced immediate downturns and finished with later positive returns.

During the accumulation phase, the sequence of your returns doesn’t matter.

Retirement investing is another game: the timing of returns matters A LOT.

A market downturn at the beginning of your retirement journey can be especially dangerous. It will rob you of time to recover, hurting the longevity of your portfolio.

Let’s look at Bob and Ted again during their retirement distribution phase. Both are withdrawing the conventionally “safe” 5% per year in this period.

The three negative years Ted’s portfolio experienced at the beginning of his retirement damaged his portfolio so much that he ran out of money after 17 years.

On the other hand, Bob still had a healthy $550,000 left for his retirement.

Both portfolios experienced the same markets but in reverse order.

That’s the hidden danger of sequence of returns risk: if you experience negative returns early in your retirement, your portfolio may suffer substantial losses that are hard to recover.

If they strike, you’ll either need to change your lifestyle to protect your portfolio or continue drawing down a damaged portfolio, effectively “locking in” those losses and reducing your portfolio’s future growth potential.

Susan and Mark had a Hard Decision to Make After the 2008 Crisis Damaged Their Retirement Portfolio.

Because they had gotten hit with a historically bad downturn right in the middle of their fragile decade, the negative returns drastically reduced their savings, forcing them to reconsider their withdrawal strategy and lifestyle.

If they had experienced those negative returns later in retirement, the impact would have been less severe because their portfolio would have had more time to grow beforehand.

Mark and Susan had a hard choice: to continue to take income from their smaller portfolio, thus “locking in” the losses, or make significant adjustments to their retirement plans and lifestyle. They even considered returning to work, even though jobs had become scarce during the downturn.

A Radical Solution to Sequence of Returns Risk: Think Income, Not Markets

When it comes to retirement, most people think of the portfolio size needed.

That’s a mistake. The real question is this:

How much income do you need to create to cover your needs, wants, and wishes?

Instead of chasing market performance in a market-based portfolio—which will always be at risk of the next downturn—think about creating income using investments that are not correlated with markets.

An income-based approach to retirement allows you to create stable retirement income while mitigating the risks of market volatility.

Going back to Mark and Susan, I’m happy to say they became clients once they realized just how badly their market-based portfolio had let them down.

We salvaged what we could of their investments and began generating stable income while allowing the rest of their portfolio to recover with growth-oriented investments.

Retirement Confidence is About Creating Income (And Preserving Your Principal)

Ultimately, it’s not about capturing every percentage of market growth. It’s about avoiding the biggest losses.

Especially during that fragile decade when the sequence of returns risk is highest.

If you’re looking ahead to your own retirement and wondering how you’ll turn your portfolio into income, you may be ready for a conversation about income-based retirement planning.

If you think the market game is rigged against retirement investors, then we should talk.

It’s why I developed a philosophy centered on creating stable, lifelong retirement income that doesn’t depend on volatile markets.

You can read more about my Lifetime Wealth BlueprintSM here.

If you’re:

- A diligent saver who is prudent with their money

- Seeking careful growth and protection from markets

- Able to invest at least 1 million dollars for your retirement

- Seeking retirement income that lasts

And you’re interested in collaborative advice that will connect you with investment options while leaving you in control of your decisions.

I’d like to invite you to an intro meeting with my team.

It’s the fastest way to get personal answers to your questions and get my advice on your own retirement.

It’s free to meet, and there’s no obligation to do anything else.

Just click the link and schedule your call.

Risk Disclosure: Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding the accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.